Cement & Contrete Cement Production and Distribution

The cement industry in South Africa has experienced very rapid expansion between 2006 and 2008 due to the increased demand as the result of extensive building and capital projects. This has led to extensive expansion of capacity, reopening of mothballed plants and a sharp increase in imports.

In the Eastern Cape the only cement producer is at New Brighton in Port Elizabeth. This plant receives over 360 000 tons of limestone in open rail wagons, from a loading area at Grassridge, 26 km from the plant. Approximately 22 000 tons of gypsum is railed from a private siding near Mount Stewart, while 50 000 tons of coal is received from mines in Mpumalanga. In addition, some 7 600 tons of iron ore is received by rail from the Northern Cape.

The output from the New Brighton plant is about 450,000 tons of cement, most of which is bagged while the balance is transported in bulk road tankers.

In addition to the production facilities in the province some 400 000 tons of bagged and bulk cement is railed from the Northern Cape to distribution points at Queenstown and Chiselhurst (East London). Final distribution is by road to points as far away as Grahamstown and Mthatha.

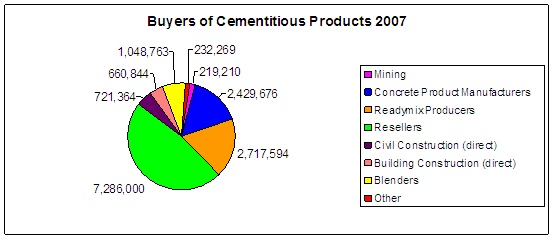

A record 15,3 million tons of cementitious products were sold in the South African region in 2007 which represented a 7,4% growth on the previous year. In 2007, the Cementitious sales by end destination for the Eastern Cape was 985 360 tons.

It is estimated according to the LHA market survey for C &CI, that the cement demand for 2008 is estimated at 16 million tons and for 2009 at 17,3 million tons.

According to the graph below, Resellers are the largest group of cementitious products, followed by readymix producers and then concrete product manufacturers.

In 2006 and 2007, the capacity of the South African production market was insufficient to fully cater for the cement demand, yet the market was fully served by the balance supplied through cement imports. Eastern Cape will remain a “net importer” of cement, due to the the output from the New Brighton plant that producers apprximately 450,000 tons of cement.

Transportation of cement products

The vehicle configuration used for transportation of cementitious products by road ranges from rigids (8 ton) to articulated, articulated + draw-bar trailers and interlinks. The vehicle type depends a lot on the commodity that is transported. Those products that are transported in a powder form would be in bags, approximately (44%), in vehicles with flatdecks or in bulk (55%), on vehicles fitted with dry bulk tankers. Those products that are readymix materials, would be transported in liquid bulk tankers.

The use of the rail network to move cement around the country from the distribution centres to the client constitutes only a small percentage of the total transport distribution, the rest is moved by road.

Each year the C&CI (Cement & Concrete Institute) report that the majority of cement is transported by road due to the industry’s lack of faith in the level of service provided by the rail network. Nothing has changed and road transportation still represents 99% of product moved to the marketplace. The bulk to bag ratio indicated an increase in bulk business.

Click here to view SA Cement Industry Facilities Click here for Cementious Sales statistics

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||