Automative Introduction

South Africa is the 18th largest manufacturer of vehicles in the world and the automotive industry is the third largest sector in South Africa, contributing 5.7% of the national GDP. The country produces 80% of Africa's vehicle output. All major motor manufacturers are represented in the country, namely BMW, GMSA, Fiat, Ford, Nissan, Toyota, VW and DaimlerChrysler.

261 000 people are employed directly in this sector with many more employed indirectly. The industry accounts for approximately 29% of South Africa's manufacturing output. South Africa 's automotive industry is a global, turbo-charged engine for the manufacture and export of vehicles and components. The sector accounts for about 10% of South Africa's manufacturing exports, making it a crucial cog in the economy. According to StatsSA the Eastern Cape recorded an increased economic growth rate of 4.5% in 2005, and in that same year the manufacturing industry, which includes the automotive industry, contributed 16.7% to the GDP of the region.

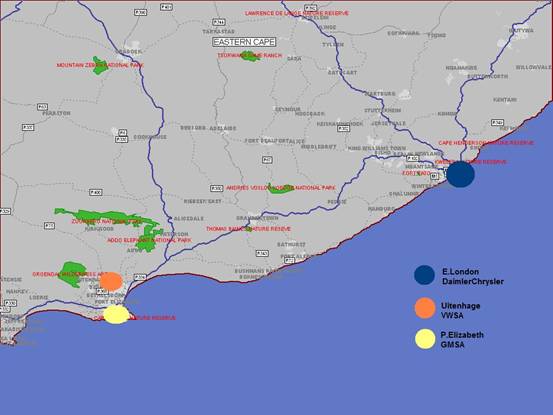

Map

Locality

The automotive industry is largely located in three provinces, namely KwaZulu Natal, Eastern Cape (coastal) and Gauteng (inland). Four manufacturing automotive companies are located within the Eastern Cape. Three in the Nelson Mandela Metropole, and one in East London.

The manufacturing company based in Port Elizabeth, markets the brands Chevrolet, Opel, Isuzu, Saab, Cadillac and Hummer. Ford, which is also based in Port Elizabeth, although their vehicle assembly operation is in Pretoria, has an engine plant in Struandale.

One of the largest car manufacturing plants is located in Uitenhage, an industrial town some 35 km from Port Elizabeth in the Eastern Cape. It is the largest German investment in South Africa and is a major contributor to foreign direct investment, technology transfer and skills development.

The automobile company located in East London, operates one of the largest passenger car manufacturing plants outside of Germany. The company`s headquarters are located in Zwartkop, Gauteng, from where the Smart, Maybach, Mitsubishi Motors, Freightliner, Western Star and Mitsubishi FUSO brands are marketed and financed.

Products

Mercedes-Benz C class and Mitsubishi vehicles are manufactured in East London. The American car maufacturer producers the Hummer at the Struandale plant and the Opel Corsa utility and Isuzu bakkies at the Kempston Plant. The Polo/classic ,Golf A5/Jetta A5 and Volkbus are manufactured at the Uitenhage plant.

The Engine Plant in Port Elizabeth is a global producer of the Ford 1.3-litre RoCam engine, which it exports together with the 1.6-litre RoCam engine to Ford plants in India and Europe. The Port Elizabeth plant is the sole supplier of the 1,3 l RoCam engine to the global Ford group. In addition, machined components are exported to China and India.

Volumes

According to NAAMSA (National Association of Automobile Manufacturers of South Africa) the annual production in 2007 was 534 490 vehicles, and the estimated projections for 2008 is 570 500 vehicles. South Africa can be regarded as a minor contributor to global vehicle production, which reached 73-million units in 2007. But, locally, the automotive sector is a giant, contributing about 7.5% to the country's gross domestic product (GDP) and employing around 36 000 people. South Africa has been one of the best performing automobile markets in the world in recent years. New vehicle sales figures soared to record-breaking levels for three years in succession, from 2004 to 2006. In 2006, sales of 587 719 was recorded, generating revenue of R118.4-billion

Although in 2007 the vehicle sales dropped by 10%, South Africa managed to export 106460 passenger vehicles and 64777 commercial vehicles. Of the passenger vehicles exported, 101 474 vehicles was overseas bound and 4 986 was exported into Africa. The European Union remains the largest export destination for South African components and accounts for about 68,7%, by value, of the industry’s component exports. The main destinations remained first world markets although emerging markets are starting to feature as export destinations indicating the South African component manufacturers’ ability to compete globally.

In the TNPA financial year 2007/2008, the port of East London exported 89 262 tons and imported 308 340 tons of vehicles in Ro-Ro ships. Likewise, the Port of Port Elizabeth exported 340 605 tons and imported 414 297 tons of vehicles. The companies like the Ford Motor Corporation of Southern Africa and Nissan already use Port Elizabeth as the harbour of choice for their imported components.

The PE based manufacturer export their vehicles into Africa includes Zimbabwe , Zambia, Malawi, Mauritius, Mozambique and Kenya

The East London plant currently produces 55 000 vehicles a year, of which more than 40 000 are right-hand drive Mercedes-Benz C-Class sedans. Seventy five 75 percent of the C-Class production is exported to several foreign markets with the UK, Japan, Australia and other Pacific Rim countries receiving the bulk. It has been reported that the Uitenhage plant plans to build around 100 000 vehicles for the 2008, of which 40 000 vehicles will be exported including a new export contract for 10 260 fifth-generation Jettas to countries including Australia, New Zealand, Japan, Great Britain and Ireland," reports Powels. The PE based engine supplier of the Ro-cam engine has a designed capacity of 200 000 engines per annum and manufactures over 900 engines daily, working around the clock with minimal disruptions. Numsa reported that the production volumes at the engine plant had declined from 206 000 engines a year to 80 000 engines a year.

Developments PE based car manufacturer

In 2005, the PE based vehicle manufacturer was awarded a six-year contract to assemble and export the Hummer H3, resulting in a US$100-million investment in its Struandale plant.

The company has built a new

multimillion-rand vehicle conversion and distribution

centre and has investing another R481-million in its

operations, upgrading its production facilities and

tooling in 2008.

The new R150 million rand vehicle conversion, storage and

distribution centre (VCDC) is now in full operation at the

Aloes Industrial Park near Markman Township and Motherwell.

East London based car manufacturer

This German car munacturer is

strategically situated near the East London port and boasts a

R5.3 million bridge linking their manufacturing facility

with the port's new vehicle terminal, streamlining the

efficient delivery of vehicles to international

markets. It has spent R1.4 billion upgrading and

expanding its East

London plant to enable the production of the new

Mercedes-Benz C-Class, for which the company was awarded

the worldwide contract. The company launched a new

manufacturing line for its subsidiary, Mitsubishi Motors

South Africa, to locally assemble the Mitsubishi Triton

Double Cab and the all new Triton ClubCab at its

manufacturing plant in East

London.

Uitenhage based German manufacturer

The company based in Uitenhage, has won a major export contract worth more than R12-billion over the next six years to supply engines to the Volkswagen Group. This year, about 27 500 five-cylinder TDI engines will be shipped to the Group’s Hannover plant in Germany for use in production of the range of LT Panel Vans. The engines will be shipped on a weekly basis, escalating to a forecasted 35 000 units next year. By 2010 an anticipated export volume of 440 000 units will be achieved.

Engine supplier of Ro-cam engines

The Port Elizabeth engine plant will start production of flex-fuel engines. These engines will be exported to South America. Flex-fuel engines can run on either petrol, ethanol (sugar-cane based fuel) or on any combination of both, as well as compressed natural gas. Although the engine has a higher fuel consumption, the running cost per kilometre of a flex-fuel engine is lower due to the generally cheaper biofuels. Current planning is for the Struandale plant to produce 5 200 flex-fuel engines in 2008, all of them exported to Ford South America.

Transport Modal Usage

Road, rail & sea is used for the transportation of units. Rail is used for distribution. The car train carries new vehicles for the PE and Uitenhage based car maufacturer for delivery to their dealers in the North of the country. At present it runs four times per week and carries some 52,000 vehicles per annum. Plans are in place to increase this capacity by making more of the specialized wagons available to the route. Road is used for inbound as well as outbound freight and sea is used for imports as well as exports. The vehicle units that are transported by sea go via Ro-Ro ships (roll-on roll-off cargo handling). Approximately 3 vessels are received per month containing imported vehicles.

Trends in transport usage & operations

The automotive industry with regard to road makes use of car carriers to transport their units, as is the case with PE based manufacturere, who transports these vehicles by road into Africa. In the event of increased production or the lack of available rail wagons, road transport would be utilised to transport the vehicle units to the reef, but at present this is done by rail.

With regard to rail, each train comprises a minimum of 22 wagons and as much as 40 wagons. The units loaded vary from 170 to 400 units. At present the sale volumes are low, but when this increases, then the amount of deliveries will increase via road and rail. Under normal conditions, rail would be utilized 7 days a week. In 2005/6, 31 693 tons and 51 751 tons of motor vehicles were railed to Gauteng from the Aloe plant in Markman and the Uitenhage plant respectively.

The Coega port is to be designed as a major distribution and processing hub for Southern Africa and beyond. Importers and exporters will be able to drive down production, procurement and supply chain management costs thanks to the fast, reliable and modern port facilities that are being built at Coega, as well as existing road, rail and air links to Southern Africa and beyond.

According to the manufacturers, there are still teething problems within the logistical chain such as there is no benchmark when comparing the pricing structure to the overseas market, trains are not reliable, container vessels delayed at Cape Town and Durban Container terminals and delays at PE port due to high winds.

Statistics of Cars Produced

|